Direct Lending Program

Home / Direct Lending Program

HALO Mortgage Advisory Inc.’s Lending Parameters

The Direct Lending Program offers brokers a streamlined way to access commercial lending directly through HALO Mortgage Advisory, enhancing their ability to serve clients with a variety of financial products. This program not only secures broker commissions in commitment letters, especially for private commercial mortgages but also benefits clients and investors. It connects clients with tailored funding solutions while offering investors high-quality mortgage investment opportunities, backed by a brokerage with a track record of due diligence management excellence.

Broker Program Specifications

Purpose:

Purchase | Refinance | Construction

Lending Areas:

GTA and Surrounding Areas

Loan Amounts:

$500,000 – $10,000,000

Max LTV:

Up to 70%

Max LTC:

Up to 70% (Construction)

Terms:

1 – 2 Years

Interest Rate:

12%*

Lender Fee:

3%*

*Special Note: We offer first mortgages and are both cash flow and equity-based lenders. We are flexible across all asset classes as long as there is a clear exit strategy and ability for repayment.

** Final interest rate & lender fee to be determined after the deal is reviewed and risk assessed.

Broker Submission Checklist

To ensure a seamless transaction, please prepare the following documentation for each deal:

Client Information:

- Borrower Mortgage Application

- Organizational Structure with Ownership Percentages

- If available beside 3 years financial statements

- Articles of Incorporation as applicable Client information

Property Documentation:

- Rent Roll

- Property Operating Statement

- Appraisal, if available

- Environmental Reports, as available

- Construction Budget for construction projects

- Approvals and Permits for construction projects

Additional Documents:

- Confirmation of down payment (For Purchase)

- Existing Mortgage Statements (For Refinance)

- 12 Months Business Bank Statements (For Refinance)

- Purchase & Sale Agreement, for purchases

*Additional requirements may apply based on your client’s specific asset class or business needs.

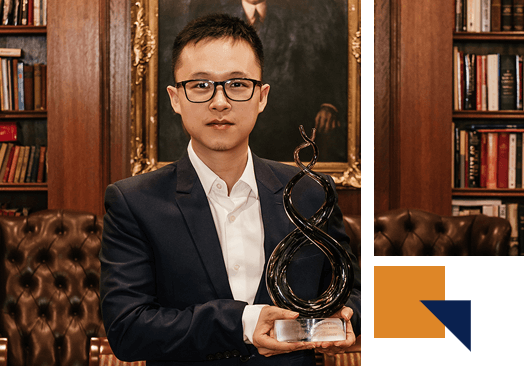

Contact Stephen Thomas

Take advantage of the opportunity to work with a lender who understands your needs and ensures that broker fees are protected at closing.

We look forward to partnering with you to provide outstanding solutions for your clients.

Frequently Asked Questions

The Direct Lending Program at HALO Advisory provides direct financing solutions to businesses and real estate developers. Unlike traditional lending which often involves intermediaries, our program offers direct loans for commercial real estate projects, development, and business expansion efforts, ensuring a streamlined and efficient funding process.

Our Direct Lending Program is designed for business owners, commercial real estate investors, and developers who require immediate and flexible financing options. It's particularly beneficial for those looking for alternatives to traditional bank loans or for projects that may not fit the typical lending criteria.

Our Direct Lending Program offers more flexibility in terms of loan structure, repayment schedules, and underwriting criteria. This program can provide faster funding approvals and disbursements, making it an ideal choice for time-sensitive projects or for borrowers seeking more personalized financing solutions.

We finance a wide range of projects, including but not limited to, commercial and residential real estate development, property acquisition, construction, and business expansion. Each project is evaluated on its merits, with a focus on income-producing and value-add opportunities.

The loan size is determined based on the project's scope, value, and borrower's financial strength. While specific amounts can vary, our Direct Lending Program is equipped to handle substantial financing needs, tailored to the scale of your project.

One of the key advantages of our Direct Lending Program is the speed of funding. Following approval, funding can typically be arranged within a few weeks, allowing your project to proceed without unnecessary delays.

Applicants should be prepared to provide detailed project plans, financial projections, and historical financial statements for existing businesses or assets. Additional documentation, such as property appraisals or construction budgets, may also be required depending on the project.

While we are open to a wide array of sectors, we generally focus on projects within the commercial real estate and business expansion domains. Projects that do not demonstrate clear income generation or growth potential may fall outside our typical financing criteria.

Interest rates and fees are competitive and reflect the risk profile of the project, the borrower's financial health, and market conditions at the time of the loan. All costs will be transparently discussed during the application process, ensuring you have a clear understanding before proceeding.

Getting started is simple. Reach out to HALO Advisory to express your interest in the Direct Lending Program. We'll schedule a consultation to understand your project or business needs and guide you through the next steps toward securing your direct loan.

Our program stands out due to our personalized approach, deep industry expertise, and the flexibility we offer our clients. With HALO Advisory, you gain a financing partner committed to seeing your project succeed, backed by years of experience in direct lending solutions.